Ciencias Psicológicas; v19(2)

July-December 2025

10.22235/cp.v19i2.4407

Original Articles

Translation, Adaptation and Validation of the Financial Distress/Financial Well-Being Scale in Economically Active Adults from the Peruvian Highlands

Traducción, adaptación y validación de la Escala de Bienestar Financiero para adultos laboralmente activos de la sierra peruana

Tradução, adaptação e validação da Escala de Bem-estar Financeiro para adultos com emprego ativo no planalto peruano

Oscar Mamani-Benito1, ORCID 0000-0002-9818-2601

Clis Oshin Palomino Mariño2, ORCID 0000-0002-8554-6066

Renzo Felipe Carranza Esteban3, ORCID 0000-0002-4086-4845

Tomás Caycho-Rodriguez4, ORCID 0000-0002-5349-7570

Ronald Castillo-Blanco5, ORCID 0000-0003-2945-3583

Milagros Yesenia Pacheco Vizcarra6, ORCID 0000-0003-0644-2574

Wilter C. Morales-Garcia7, ORCID 0000-0003-1208-9121

1 Universidad Señor de Sipán, Peru, [email protected]

2 Universidad Peruana Unión, Peru

3 Universidad San Ignacio de Loyola, Peru

4 Universidad Científica del Sur, Peru

5 Universidad Científica del Sur, Peru

6 Universidad Nacional del Altiplano, Peru

7 Universidad Peruana Unión, Peru

Abstract:

Having financial well-being reduces stress and improves quality of life. Given the scarcity of validated instruments in Peru, this study aimed to analyze the psychometric properties of the Financial Distress/Financial Well-Being Scale in workers from the Peruvian highlands. Using an instrumental design, 1,059 workers of both sexes, aged between 18 and 65 years, voluntarily participated. The participants were recruited from three cities in southern Peru: Cuzco, Arequipa, and Puno. The results showed that all items were positively evaluated by expert judges. The internal structure was validated through confirmatory factor analysis, which confirmed the original model: CFI = .992, RMSEA = .063, SRMR = .027, with factor loadings ranging from .34 to .79, and very good reliability (ω = .82). Additionally, the scale demonstrated invariance by gender and type of work, showing significant correlations with other instruments measuring Financial Stress, General Well-Being, and Life Satisfaction, indicating its convergent validity. In conclusion, the translated and adapted Financial Well-Being Scale for the Peruvian context (EBF-Per) is a brief, valid, and reliable measure for Peruvian workers, making it useful for research aimed at evaluating levels of financial well-being.

Keywords: factor analysis; invariance; reliability; financial well-being; workers; Peru.

Resumen:

El bienestar financiero ayuda a reducir el estrés y mejorar la calidad de vida. Ante la escasez de instrumentos validados en Perú, se tuvo como objetivo analizar las propiedades psicométricas de la Financial Distress/Financial Well-Being Scale en trabajadores de la sierra peruana. Bajo un estudio de diseño instrumental, participaron voluntariamente 1.059 trabajadores de ambos sexos, con edades comprendidas entre 18 y 65 años. Los participantes fueron reclutados de tres ciudades del sur peruano: Cuzco, Arequipa y Puno. Como resultados, todos los ítems fueron evaluados favorablemente por los jueces expertos. La estructura interna se validó mediante el análisis factorial confirmatorio, con el que se confirmó el modelo original: CFI = .992, RMSEA = .063, SRMR = .027, teniendo cargas factoriales entre .34 y .79, y una fiabilidad muy buena (ω = .82). También la escala demostró ser invariante según género y tipo de trabajo, con correlaciones significativas con otros instrumentos que miden el estrés financiero, el bienestar general y la satisfacción con la vida, lo que da cuenta de su validez convergente. En conclusión, la Escala de Bienestar Financiero traducida y adaptada al contexto peruano (EBF-Per) es una medida breve, válida y confiable para trabajadores peruanos, por lo que puede ser útil en investigaciones orientadas a evaluar el nivel de bienestar financiero.

Palabras clave: análisis factorial; invarianza; confiabilidad; bienestar financiero; trabajadores; Perú.

Resumo:

O bem-estar financeiro ajuda a reduzir o estresse e a melhorar a qualidade de vida. Diante da escassez de instrumentos validados no Peru, o objetivo foi analisar as propriedades psicométricas da Financial Distress/Financial Well-Being Scale em trabalhadores da serra peruana. Em um estudo de delineamento instrumental, participaram voluntariamente 1059 trabalhadores de ambos os sexos, com idades entre 18 e 65 anos. Os participantes foram recrutados em três cidades do sul peruano: Cuzco, Arequipa e Puno. Como resultados, todos os itens foram avaliados favoravelmente por juízes especialistas. A estrutura interna foi validada por meio de análise fatorial confirmatória, na qual o modelo original foi confirmado: CFI = 0,992, RMSEA = 0,063, SRMR = 0,027, com cargas fatoriais entre 0,34 e 0,79, e confiabilidade muito boa (ω = 0,82). A escala também se mostrou invariante segundo gênero e tipo de trabalho, com correlações significativas com outros instrumentos que mensuram Estresse Financeiro, Bem-estar Geral e Satisfação com a Vida, o que evidencia sua validade convergente. Em conclusão, a Escala de Bem-estar Financeiro traduzida e adaptada ao contexto peruano (EBF-Per) é uma medida breve, válida e confiável para trabalhadores peruanos, podendo ser útil em pesquisas voltadas à avaliação do nível de bem-estar financeiro.

Palavras-chave: análise fatorial; invariância; confiabilidade; bem-estar financeiro; trabalhadores; Peru.

Received: 12/12/2024

Accepted: 17/09/2025

The global economy, in the process of recovery, has highlighted the importance of healthy spending and saving habits (Ibn-Mohammed et al., 2021). According to the Organization for Economic Co-operation and Development (OECD, 2024), household saving rates have decreased in industrialized countries, with worrying forecasts for the Eurozone and the United States. The current labor market situation and consumer demand, combined with low interest rates, have reduced the attractiveness of traditional savings accounts. Thus, there is variability in the perception of Financial Well-Being (FWB) among individuals, influenced by personal and contextual factors (Estela-Delgado et al., 2023).

Households face significant financial challenges due to increasing indebtedness from loans, a situation exacerbated by reduced public investments and changing economic conditions (Martin & Dwyer, 2021). Despite recommendations to save 15 % to 20 % of annual income to ensure a comfortable retirement, the reality is that for many actively employed workers, retirement is not an immediate priority (Muat et al., 2024). This critical situation, linked to a lack of financial planning skills and harmful consumer behaviors, shows a significant correlation between financial fragility and general well-being (Bialowolski et al., 2021).

FWB thus becomes critically relevant. Researchers and scholars emphasize the need to understand how to motivate people towards healthier spending and saving behaviors (Mende & van Doorn, 2015). In this regard, FWB in Perú has faced major challenges due to both global and local economic factors, resulting in job instability and financial concerns. Financial risks have negatively affected businesses and the workforce, leading to layoffs, business closures, and employment uncertainty. There has been an increase in unemployment and economic difficulties for micro and small enterprises, directly impacting family well-being and economic stability (Estela-Delgado et al., 2023).

While essential, the concept of FWB still lacks a universally accepted definition and measurement method (Aubrey et al., 2022). However, there is consensus in understanding it as the individual perception of maintaining a desired standard of living and achieving financial freedom. This concept has evolved to include both objective dimensions, such as possession of material resources, income, and debts, and subjective dimensions focused on personal perception and satisfaction regarding financial situation (Estela-Delgado et al., 2023). Current definitions and measurements of FWB are varied and cover multiple facets, integrating approaches that jointly consider tangible aspects of personal economy and subjective factors related to individual economic perception (Shim et al., 2009). Thus, FWB has a direct relationship with financial literacy, a topic that encompasses not only knowledge but also the skills necessary to actively engage in markets. Therefore, it is expected that adequate financial education will foster specific competencies in informed decision-making, proper risk management, and sound planning, thereby promoting long-awaited economic security and sustainable well-being, as evidenced in certain international policies (OECD, 2023).

Regarding the evaluation of this concept, over the years, various instruments have been developed to measure FWB. Since 1985, certain socio-demographic indicators proposed by Williams represented one of the first attempts to understand this construct (Williams, 1989). Later, in the following two decades, there was great interest in the development of ad hoc instruments (De Oliveira et al, 2023), However, many instruments lacked the capacity to capture the complexity of this construct, making it necessary to create more sophisticated scales that offered a nuanced view of the concept (Aubrey et al., 2022).

In this context, the research conducted by Mendes et al. (2023), stands out. They developed the Perceived Financial Well-Being Scale (PFWBS), a test consisting of 23 items distributed across four factors. Additionally, other scales have been compiled in the systematic review by De Oliveira et al. (2023). Among them are the Financial Distress/Financial Well-Being Scale (IFDFW) developed by Prawitz et al. (2006) and the Financial Well-Being Scale (Consumer Financial Protection Bureau, 2015), both composed of 8 and 10 items distributed in a single factor. Also included is the Perceived Financial Well-Being Scale (PFWBS) created by Netemeyer et al. (2018), which consists of 10 items distributed across two dimensions. Finally, the Multidimensional Subjective Financial Well-Being Scale (MSFWBS) by Sorgente and Lanz (2019) which includes 25 items distributed across five dimensions; both are focused on evaluating subjective financial well-being.

Several of these scales have been adapted and validated in different countries. Ponchio et al. (2019) validated Netemeyer et al. (2018)’s scale in Brazilian adults, removing two items to improve model fit. Similarly, Utkarsh et al. (2020) evaluated the psychometric performance of Prawitz et al. (2006)’s scale in young adults in India, confirming the original version. In Peru, Millones-Liza and García-Salirrosas (2024) confirmed the validity and reliability of this same scale in a sample of Peruvian citizens, supporting its original structure. In a deeper analysis of financial well-being, Aubrey et al. (2022) studied the Multidimensional Subjective Financial Well-Being Scale (MSFWBS) by Sorgente and Lanz (2019) in French-Canadian adults. They applied advanced models such as Bifactor-CFA and Bifactor-ESEM, confirming the proposed structure. Subsequently, Sorgente et al. (2024) extended this evaluation to emerging adults from nine countries (Austria, Canada, Finland, India, Italy, Portugal, Romania, Slovenia, and Turkey), finding valid and reliable results for the five-factor multidimensional model. Finally, De Oliveira et al. (2024) replicated these findings in Brazil, validating the same structure in an adult sample.

Given this range of tools available for assessing FWB, the authors of the present study also decided to adapt and validate a measure capable of adjusting to the cultural diversity, socioeconomic characteristics, and specificities of the Peruvian financial system. In this case, the InCharge Financial Distress/Financial Well-Being Scale developed by Prawitz et al. (2006), was chosen, as it is a self-reported and easy-to-administer instrument. This measure has shown strong performance in studies reported in the literature, such as those conducted with adults and public employees in Malaysia (Mahdzan et al., 2020; Mokhtar et al., 2015), healthcare personnel in Ecuador (Lobos et al., 2021), adults in the United States (O’Neill et al., 2005) and Australia (Gerrans et al., 2014), families in Nigeria (Kemisola et al., 2019), investors in India (Sivaramakrishnan & Srivastava, 2019) and South Africa (Dickason-Koekemoer & Ferreira, 2019) as well as citizens in Saudi Arabia (El Zouki et al., 2025).

Although this measure has already been validated for the Peruvian context (Millones-Liza & García-Salirrosas, 2024), the cited research lacks relevant information regarding the source of the version used for adaptation. In that study, it is implied that they worked with a Spanish-translated version, but the source was not disclosed. By contrast, the only Peruvian study explicitly describing the translation of this scale is that of Estela-Delgado et al. (2023), which reports having used a six-item version, different from the original and from other international adaptations. Furthermore, while they presented evidence supporting construct validity and reliability, they did not include results on content validity or provide details on the statistical procedures employed.

Considering this gap in knowledge, it becomes necessary to properly explore the psychometric performance of the InCharge Financial Distress/Financial Well-Being Scale in the economically active population, namely workers dependent on regular (salaried) or irregular (entrepreneurial) income, which directly affects both financial and mental well-being (Kieft et al., 2024). Conversely, unemployed individuals often experience financial concerns, stress, and lower economic satisfaction, which may require conceptual adaptations or specific items to reflect these differences (Connolly & Gärling, 2022). Since this instrument is designed to measure FWB quickly and with practical applications such as interventions, validating the scale in workers with regular incomes enables the generation of specific data for public policies or companies seeking to enhance workforce well-being (Mathew et al., 2022).

In a relevant note on financial well-being, previous studies have reported differences between men and women, which can be explained by factors such as income inequality or labor force participation. Traditionally, men have reported higher levels of perceived financial well-being (Culebro-Martínez et al., 2025). Considering these differences across groups provides an opportunity to assess known-groups validity for the instrument under study (Hubley & Zumbo, 2011).

For all these reasons, the purpose of the present study is to analyze the psychometric properties of the Financial Distress/Financial Well-Being Scale among workers in the Peruvian highlands through several procedures: content validity analysis, confirmatory factor analysis, evaluation of internal consistency, measurement invariance testing, known-groups validity, and convergent validity.

Method

Design

This was an instrumental design study, as it analyzed the main psychometric properties of a documentary measurement instrument (Ato et al., 2013).

Participants

Using a non-probabilistic intentional sampling method, 1,059 economically active adults (50.2 % men) aged between 18 and 65 years (M = 25.3, SD = 8.0) voluntarily participated. Participants were recruited from three cities in the Peruvian highlands: Arequipa (50.5 %), Cusco (28.3 %), and Puno (21.2 %). Most had completed higher education (80.9 %), followed by secondary education (16.3 %). Furthermore, 57.2 % were dependent workers (salaried employees) and 42.8 % were independent workers (self-employed). Inclusion criteria included being of legal age, providing informed consent, and completing the entire questionnaire.

Instruments

The instrument subjected to psychometric exploration was the Financial Distress/Financial Well-Being Scale (Prawitz et al., 2006). This measure consists of eight questions with response options scaled from 1 to 10. However, the labels vary depending on the item: four options for items 1, 3, 4, 5, 6, 7, and 8, and two options for item 2. The items assess the individual’s subjective perception of their current financial situation, their level of stress related to finances, and the frequency with which they face specific economic difficulties. The response options, organized into 4- or 10-point scales, allow for the classification of these perceptions from lower to higher intensity or frequency. For instance, questions related to financial stress (items 1 and 8) use a scale ranging from “no stress” to “overwhelming stress,” reflecting the emotional impact of the financial situation.

Financial Stress Scale (EFT-Cov19; Carranza et al., 2021). Created for economically active adults in Peru. It consists of seven statements, such as item 6: “I am worried about losing my home or not being able to pay the rent due to the financial crisis”, with response options in a five-point Likert format: 1: Strongly disagree to 5: Strongly agree.

World Health Organization Well-Being Index (WHO-5). Translated and validated into Spanish by Simancas-Pallares et al. (2016) and validated for the Peruvian population by Caycho-Rodríguez et al. (2020). It is composed of five statements, such as item 1: “I have felt cheerful and in good spirits”, with response options in a four-point Likert format: 0: Never to 3: Always.

Satisfaction with Life Scale (SWLS; Diener et al., 1985). Translated into Spanish by Pons et al. (2002) and validated for the Peruvian context by Caycho-Rodríguez et al. (2018). It is composed of five statements, such as item 5: “The circumstances of my life are good”, with response options in a five-point Likert format: 1: Strongly disagree to 5: Strongly agree.

Procedures

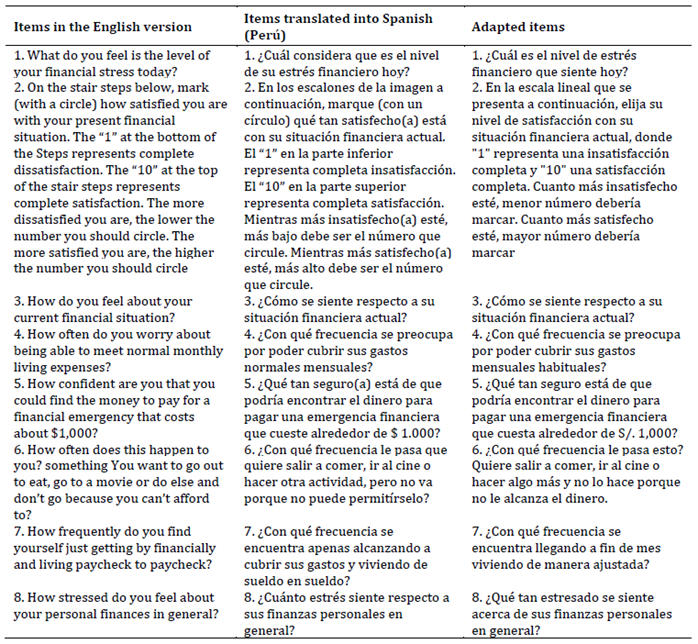

The study was conducted in stages. First, for the back-translation process, the support of four certified bilingual translators with advanced English proficiency was requested. Two of them were in charge of the direct translation, and the other two of the indirect translation (EnglishàSpanish, SpanishàEnglish). Subsequently, the research team held a virtual meeting to review the translations, making minor adjustments where appropriate. For example, in the direct translation of item 1 “What do you feel is the level of your financial stress today?” translator 1 rendered it as “¿Cuál cree usted que es su nivel de estrés financiero hoy?”, whereas translator 2 wrote “¿Cuál considera usted que es el nivel de su estrés financiero hoy?”. In this case, the authors decided to adjust the item to “¿Cuál es el nivel de estrés financiero que siente hoy?”. As a result of this review, a consolidated version was produced, named EBF-Per (Table 1).

Second, the content validity of the EBF-Per was assessed using expert judgment. Six specialists were invited: two mental health professionals (one in clinical and health psychology and another in organizational psychology), two business administrators (one in a managerial position and another as a human resource director), an economist, and a physician specializing in occupational health. They received a validation form proposed by Ventura-León (2019), which guided the evaluation of each item in terms of clarity, representativeness, and relevance. In this case, no major observations were made regarding adding or removing items; only minor observations such as modifying certain words. For example, item 5 originally stated: “¿Qué tan seguro estás de encontrar dinero para asumir una emergencia financiera de alrededor de S/. 1,000?”. Based on the recommendations of two judges, it was modified to “¿Qué tan seguro está de que podría encontrar el dinero para pagar una emergencia financiera que cuesta alrededor de S/. 1,000?”.

Third, once the validated version was finalized, Google Forms was used to administer the scales. The necessary instructions for completion were provided. In the initial section of the questionnaire, informed consent was presented, the purpose of the study was explained, and it was emphasized that participation was anonymous and voluntary, and that the information collected would be used solely for research purposes. The process of completing the online form took approximately 10 to 15 minutes. This resource was available online from September 29 to November 15, 2023.

Data analysis

To analyze the factorial structure, Confirmatory Factor Analysis (CFA) was used. Considering the ordinal nature of the items, calculations were performed using a polychoric correlation matrix. In this case, the estimator applied was the Weighted Least Squares Mean and Variance adjusted (WLSMV), a procedure recommended for ordinal variables (Beauducel & Herzberg, 2006; Gana & Broc, 2019). The global evaluation of model fit was obtained with the Comparative Fit Index (CFI), the Root Mean Square Error of Approximation (RMSEA), and the Standardized Root Mean Square Residual (SRMR). Values of CFI > .90 were interpreted as favorable evidence of model fit (Bentler, 1990), as well as RMSEA < .080 (MacCallum et al., 1996) and SRMR < .080 (Browne & Cudeck, 1992).

To analyze reliability, the internal consistency method was applied using the omega (ω) coefficient, with values above .70 considered acceptable. The correction formula of the omega coefficient was also taken into account in cases of correlated errors.

To evaluate generalizability, measurement invariance analysis was conducted, and given the ordinal nature of the items, the recommendations of Wu and Estabrook (2016) and Svetina et al. (2020) for invariance testing with ordinal variables were followed. Thus, three hierarchical restrictive models were evaluated across groups according to gender and work type: configural, threshold, and threshold and loading invariance, all tested using the WLSMV estimator for ordinal data. In addition, for measurement invariance testing, a set of criteria was assessed, consisting of changes in CFI < .010, RMSEA < .015, or SRMR < .005 (Chen, 2007), with at least two of these conditions being met.

To assess convergent validity, correlation analyses were carried out using Pearson’s r coefficient between the scores of the Financial Distress/Financial Well-Being Scale and related but conceptually distinct measures, such as financial stress, general well-being, and life satisfaction.

All analyses were performed using R software, version 4.2.3, specifically with the lavaan package, version 0.6-15 (Rosseel, 2012).

Ethical considerations

With respect to the ethical aspects of the research, the ethical principles for human research established in the Declaration of Helsinki were followed. The study was approved by the ethics committee of Universidad Peruana Unión (N° 2024-CEUPeU-005).

Results

Table 1 presents the back-translation and adaptation of the items of the EBF-Per, demonstrating a rigorous process in which semantic equivalence and conceptual clarity were maintained. The linguistic adjustments made ensure natural and context-appropriate language for Peruvian speakers, thereby guaranteeing content validity and proper comprehension, both of which are essential for psychometric application and subsequent analyses.

Table 1: Back-translation and adaptation of the EBF-Per ítems

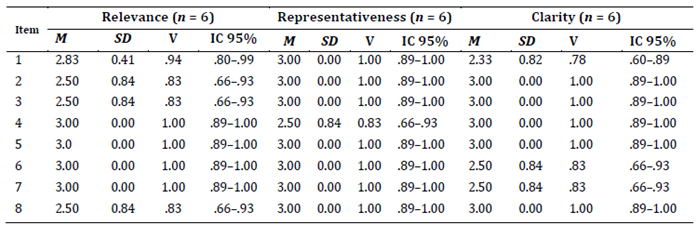

Content validity

According to the observations in Table 2, items 4, 5, 6, and 7 were deemed relevant by expert judges (V = 1.00; 95 % CI .89 – 1.00). Items 1, 2, 3, 5, 6, 7, and 8 are considered fully representative (V = 1.00; 95 % CI .89 – 1.00). Finally, items 2, 3, 4, 5, and 8 were found to be the clearest (V = 1.00; 95 % CI 0.89 – 1.00).

Table 2: Aiken's V for evaluating the relevance, representativeness, and clarity of items on the EBF-Per

Note: M: Mean, SD: Standard Deviation, g1: Skewness, g2: Kurtosis.

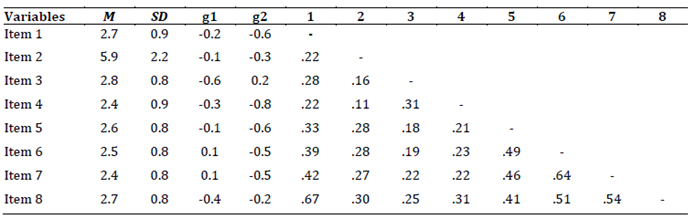

Descriptive analysis and item correlations

Prior to the structural analysis, descriptive results and the polychoric correlation matrix of the items were obtained, as shown in Table 3. Initially, the skewness (g1) and kurtosis (g2) values are observed, which fall within the suggested ranges. Regarding the intercorrelations, these range between .11 and .67.

Table 3: Descriptive statistics and polychoric correlations of the EBF-Per ítems

Note: M: Mean, SD: Standard Deviation, g1: Skewness, g2: Kurtosis.

Validity based on internal structure and reliability

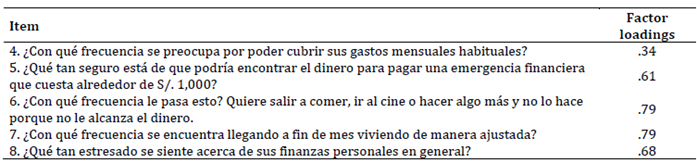

The CFA evaluated the unidimensional structure of the instrument, including all items; however, the goodness-of-fit indices were not favorable: χ²(20) = 331.61, p < .001; CFI = .929; RMSEA = .121; SRMR = .058. Although the factor loadings were above .30 for all items and the reliability according to Omega was .79 for the total scale, the evaluation of the modification indices revealed significant covariance between item 1 and item 8, suggesting local dependence and redundancy between them. Similarly, item 3 showed a suboptimal factor loading and a high residual covariance with item 4. Since item 4 was conceptually more specific and demonstrated better psychometric properties, item 3 was considered to contribute redundant variance. Lastly, item 2 presented an incompatible response format, with twice as many options compared to the other items, which hindered its proper rescaling for model estimation. For these reasons, items 1, 2, and 3 were removed to improve factorial validity and model parsimony. The revised model demonstrated substantially better fit: χ²(5) = 26.15, p < .001; CFI = .992; RMSEA = .063; SRMR = .027, with standardized factor loadings ranging from .34 to .79. Internal reliability improved to ω = .82 (Table 4).

Table 4: Standardized factor loadings of the confirmatory factor analysis for the respecified structure

Measurement invariance

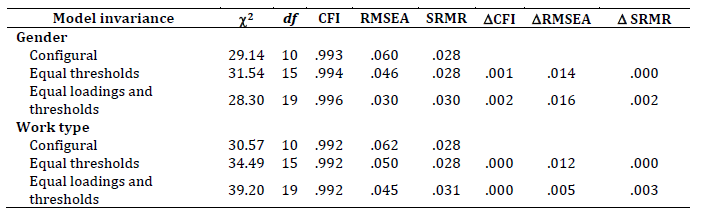

In the measurement invariance analysis (Table 5), the fit was first evaluated for the two groups defined by gender, and then they were combined to estimate and assess the first level of invariance. Configural invariance showed an acceptable fit, χ²(10) = 29.1, p < .001, CFI = .993, RMSEA = .060, SRMR = .028. The subsequent levels of invariance were then tested, and the criteria for changes in CFI, RMSEA, and SRMR (Chen, 2007) were met up to the strict level. Table 5 also shows the measurement invariance results for work type groups, where a good configural fit was also obtained, χ²(10) = 30.57, p < .001, CFI = .992, RMSEA = .062, SRMR = .028, with adequate values in the changes of CFI, RMSEA, and SRMR up to the strict level. Considering the confirmation of all levels of measurement invariance, differences by gender were assessed, and no significant differences were found, t(1057) = .053, p < .001, d = .00, with scores being essentially very similar between men (M = 15.3, SD = 5.6) and women (M = 15.2, SD = 5.7).

Table 5: Measurement invariance of the final model considering gender and work type

Note: CFI: comparative fit index; RMSEA: root mean standard error of approximation; SRMR: square root mean residual. All statistical significance values correspond to p < .001.

Convergent validity

Finally, prior to the convergent validity analysis, the score of the Financial Well-Being Scale was calculated as the average of the items after items 1, 2, and 3 had been removed. In this way, significant correlations were obtained between the Financial Distress/Financial Well-Being Scale and the Financial Stress Scale, r = –.38, p < .001, the General Well-Being Index, r = .38, p < .001, and the Satisfaction with Life Scale, r = .33, p < .001.

Discussion

Given the significance of FWB as an indicator of quality of life and overall well-being among the working population in Perú, the aim was to evaluate the psychometric properties of the Financial Distress/Financial Well-Being Scale in a sample of actively employed adults in the Peruvian highlands. Specifically, evidence was gathered regarding its internal structure, reliability, measurement invariance by gender, and both convergent and divergent validity to test the proposition that the subjective experience of one's financial situation has a unidimensional structure, as demonstrated in the original model.

As the main finding regarding internal structure, results indicate that the EBF-Per should be interpreted as a unifactorial measure composed of five items, since the CFA showed that the original model with 8 items did not present a good fit in the sample. This outcome was not expected, as most previous studies that used this scale for adaptation and validation confirmed the eight-item structure under a unidimensional model (Gerrans et al., 2014; Lobos et al., 2021; Mahdzan et al., 2020; O’Neill et al., 2005). In this case, item 1, “What is the level of financial stress you feel today?”, item 2 “On the scale presented below, choose your level of satisfaction with your current financial situation”, and item 3 “How do you feel about your current financial situation?” were removed due to their poor fit with the theoretical unidimensional model and their reduced consistency with the remaining items. From a statistical perspective, these items displayed lower factor loadings and less consistent correlations with the other items of the scale, while their removal improved the overall fit.

From a conceptual perspective, items 1 and 3 introduce a more direct measurement of perceived stress or satisfaction at a specific point in time, which may reflect temporary emotional states rather than a stable and general assessment of financial well-being. Regarding item 2, by evaluating general and transitory perceptions instead of perceptions, behaviors, or specific financial resources as the remaining items do it may have introduced irrelevant variance, distancing it from the unidimensional character of the scale. Removing these items significantly improved model fit, reinforcing the proposal to retain a five-item version focused on the individual’s perception of their financial situation, which is the construct being measured. Postponing the inclusion of certain items is consistent with recommended practices in instrument validation, where modifications should be considered to avoid introducing irrelevant variance in the measurement of the construct (Hubley & Zumbo, 2011).

In the present study, no differences were found in financial well-being scores between men and women, indicating that gender did not constitute a differentiating factor in the subjective perception of financial well-being. This finding contrasts with previous literature reporting lower levels of financial well-being among women (Culebro-Martínez et al., 2025). The absence of differences may be explained by the particular characteristics of the sample, which presented heterogeneity in educational level and employment type. The high proportion of participants with higher education and the generalized access to resources, whether through dependent or independent work, may have attenuated the gender differences documented in other contexts. This is further reinforced by the fact that financial well-being depends mainly on subjective evaluation of one’s own financial situation (Brüggen et al., 2017), suggesting that current aspects of gender and social roles may also explain these results. The lack of differences found in this study does not allow mean comparison to be used as a form of known-groups validity testing (Hubley & Zumbo, 2011), but it does lead to the suggestion that future research should explore potential moderators such as income level, job stability, or age, which could interact with gender in determining subjective financial well-being.

Regarding the evidence for convergent validity, it was demonstrated through the relationship between EBF-Per, general well-being, and life satisfaction. This indicates that individuals with high levels of FWB also likely reported high levels of happiness and general well-being (Ngamaba et al., 2020). This could be explained by economic income, which is important for maintaining a suitable standard of living or living better (Ng & Diener, 2014). The medium size of the correlation coefficients does not suggest a total relationship or that the concepts of the variables are completely synonymous. However, the magnitude of correlation between EBF-Per, life satisfaction, and general well-being in Perú was stronger than that observed in developed countries (Ng & Diener, 2014). This suggests that financial well-being may be more closely related to well-being and happiness in poorer countries, as people would feel satisfied with meeting basic needs for food, healthcare, and education (Ngamaba et al., 2020). On the other hand, a high level of financial stress was related to lower FWB, as mentioned in other studies (Ismail & Amiruddin Zaki, 2019; Rahman et al., 2021). This could be explained by the fact that individuals with higher self-reported financial stress were less satisfied with their financial situation (Mahdzan et al., 2019). This would be expected in a country like Perú, which faces a context of financial uncertainty where FWB is not guaranteed due to the presence of low economic incomes, debts, etc., that increase the financial burden on active workers.

This study provides the first findings on the measurement invariance of the EBF-Per across a large number of male and female participants. Evidence was provided demonstrating that FWB, measured using the EBF-Per, has the same meaning and is comparable between men and women groups. This allows for the comparison of the latent means of FWB between both groups and to detect differences between groups.

Limitations

Despite significant findings, several limitations must be noted to better interpret the results. First, since a non-probabilistic sampling method was applied, the findings of this study apply directly to economically active adults from the three cities of the highlands where the sample was collected: Arequipa, Cuzco, and Puno. Therefore, to achieve greater generalizability, additional studies are needed to replicate the results with probabilistic samples from the three regions of Perú. Second, data derived from online surveys may be biased, showing self-selection and dropout biases. However, the use of online surveys is a common practice due to budget and time constraints. Efforts were made to overcome the limitations of convenience online questionnaires by obtaining a large sample size, as recommended in scientific literature. Third, the cross-sectional design of the study did not allow for the observation of how different external factors, such as unemployment, health problems, or the macroeconomic situation, can dynamically influence a person’s financial well-being and other related variables (financial stress, general well-being, and life satisfaction) over time. Therefore, future studies should explore the relationships among these variables over time using data from longitudinal designs. Fourth, since the EBF-Per is a self-report measure, the findings may be subject to social desirability bias. Individuals might misrepresent their actual FWB to appear more favorable compared to others. Therefore, financial institutions should apply the EBF-Per with caution, as users expected to score high on the scale might deliberately conceal the truth about their financial FWB. This suggests that the scale might yield more reliable results when its scores are analyzed alongside objective financial indicators. Fifth, the study did not consider how the subjective assessment of FWB was related to the participants' actual financial situation. Thus, future studies should consider exploring this relationship in order to better understand the correspondence between financial well-being and the individual’s real economic situation. Finally, it did not examine how the four constructs assessed here are related to other constructs in the nomological network of FWB. Further studies are needed to provide more evidence for the predictive validity of the EBF-Per.

The unidimensionality of the scale limits the ability of the instrument to reflect the complexity and diversity of financial experiences across different contexts. Therefore, it is recommended that future research expands the scope of the instrument to address the diversity of financial experiences and needs present in the general population.

Conclusion

The findings of this study suggest that the EBF-Per provides valid interpretations, reliable scores, is invariant between men and women, producing comparable scores between groups, and exhibits significant relationships with financial stress, general well-being, and life satisfaction. In a context of economic uncertainty in Perú, having such a measure, with adequate psychometric evidence, is an important tool for researchers, professionals, and policymakers to gain more information about the FWB of working adults and monitor its variations over time.

References

Ato, M., López, J. J., & Benavente, A. (2013). A classification system for research designs in psychology. Anales de Psicologia, 29(3), 1038-1059. https://doi.org/10.6018/analesps.29.3.178511

Aubrey, M., Morin, A., Fernet, C., & Carbonneau, N. (2022). Financial well-being: Capturing an elusive construct with an optimized measure. Frontiers in Psychology, 13, 935284. https://doi.org/10.3389/fpsyg.2022.935284

Beauducel, A., & Herzberg, P. Y. (2006). On the performance of maximum likelihood versus means and variance adjusted weighted least squares estimation in CFA. Structural Equation Modeling: A Multidisciplinary Journal, 13(2), 186-203. https://doi.org/10.1207/s15328007sem1302_2

Bentler, P. (1990). Comparative fit indices in structural models. Psychological Bulletin, 107(2), 238-246.

Bialowolski, P., Weziak-Bialowolska, D., & McNeely, E. (2021). The role of financial fragility and financial control for well-being. Social Indicators Research, 155(3), 1137-1157. https://doi.org/10.1007/s11205-021-02627-5

Browne, M. W., & Cudeck, R. (1992). Alternative ways of assessing model fit. Sociological Methods & Research, 21(2), 230-258. https://doi.org/10.1177/0049124192021002005

Brüggen, E. C., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228-237. https://doi.org/10.1016/j.jbusres.2017.03.013

Carranza, R. F., Mamani-Benito, O., Rodriguez-Alarcón, J. F., Villafuerte, A. S., Arias-Chávez, D., & Mejia, C. R. (2021). Diseño y validación de una escala de estrés financiero en trabajadores dependientes Peruanos durante la pandemia del COVID-19 (EFT-Cov19). Boletin de Malariologia y Salud Ambiental, 61(2), 181-187. https://doi.org/10.52808/BMSA.7E5.61E2.021

Caycho-Rodríguez, T., Ventura-León, J., Azabache-Alvarado, K., Reyes-Bossio, M., & Cabrera-Orosco, I. (2020). Validez e invariancia factorial del Índice de Bienestar General (WHO-5 WBI) en universitarios Peruanos. Revista Ciencias de La Salud, 18(3), 1-15. https://doi.org/10.12804/revistas.urosario.edu.co/revsalud/a.9797

Caycho-Rodríguez, T., Ventura-León, J., García Cadena, C. H., Barboza-Palomino, M., Arias Gallegos, W. L., Dominguez-Vergara, J., Azabache-Alvarado, K., Cabrera-Orosco, I., & Samaniego Pinho, A. (2018). Psychometric evidence of the Diener’s Satisfaction with Life Scale in Peruvian elderly. Revista Ciencias de La Salud, 16(3), 488. https://doi.org/10.12804/revistas.urosario.edu.co/revsalud/a.7267

Chen, F. F. (2007). Sensitivity of goodness of fit indexes to lack of measurement invariance. Structural Equation Modeling: A Multidisciplinary Journal, 14(3), 464-504. https://doi.org/10.1080/10705510701301834

Connolly, F., & Gärling, T. (2022). Mediators of differences between employed and unemployed in life satisfaction and emotional well-being. Journal of Happiness Studies, 23, 1637-1651. https://doi.org/10.1007/s10902-021-00466-2

Consumer Financial Protection Bureau. (2015). Measuring financial well-being: A guide to using the CFPB Financial Well-Being Scale. https://www.consumerfinance.gov/data-research/research-reports/financial-well-being-scale/

Culebro-Martínez, R., Larracilla-Salazar, N., & Moreno-García, E. (2025). Objective and subjective financial wellbeing: A gender study of financial behavior in Mexico. Journal of Advocacy, Research and Education, 12(1). https://doi.org/10.13187/jare.2025.1.59

De Oliveira, N., de Lara Machado, W., Sorgente, A., & Guilherme, A. A. (2024). Cross-cultural adaptation and validation of the Multidimensional Subjective Financial Well-Being Scale in Brazilian adults. Journal of Family and Economic Issues. https://doi.org/10.1007/s10834-024-09965-9

De Oliveira, N., Markus, J., De Lara, W., & Guilherme, A. (2023). Measuring financial well-being: A systematic review of psychometric instruments. Journal of Happiness Studies, 24(8), 1-27. https://doi.org/10.1007/s10902-023-00697-5

Dickason-Koekemoer, Z., & Ferreira, S. (2019). A conceptual model of financial well-being for south african investors. Cogent Business and Management, 6(1), 1-13. https://doi.org/10.1080/23311975.2019.1676612

Diener, E., Emmons, R. A., Larsen, R. J., & Griffin, S. (1985). The Satisfaction With Life Scale. Journal of Personality Assessment, 49(1), 71-75. https://doi.org/10.1207/s15327752jpa4901_13

El Zouki, C., Chahine, A., Hallit, R., Malaeb, D., El Khatib, S., Nehme, A., Obeid, S., Fekih-Romdhane, F., & Hallit, S. (2025). Arabic validation of the incharge financial distress/financial well-being scale and the new single-item financial stress scale. Frontiers in Publlic Health, 13, 1570404. https://doi.org/10.3389/fpubh.2025.1570404

Estela-Delgado, B., Montenegro, G., Paan, J., Morales-García, W. C., Castillo-Blanco, R., Sairitupa-Sanchez, L., & Saintila, J. (2023). Personal well-being and financial threats in Peruvian adults: The mediating role of financial well-being. Frontiers in Psychology, 13, 1-9. https://doi.org/10.3389/fpsyg.2022.1084731

Gana, K., & Broc, G. (2019). Structural Equation Modeling with lavaan. Wiley.

Gerrans, P., Speelman, C., & Campitelli, G. (2014). The relationship between personal financial wellness and financial wellbeing: A structural equation modelling approach. Journal of Family and Economic Issues, 35(2), 145-160. https://doi.org/10.1007/S10834-013-9358-Z

Hubley, A. M., & Zumbo, B. D. (2011). Validity and the consequences of test interpretation and use. Social Indicators Research, 103(2), 219-230. https://doi.org/10.1007/s11205-011-9843-4

Ibn-Mohammed, T., Mustapha, K. B., Godsell, J., Adamu, Z., Babatunde, K. A., Akintade, D. D., Acquaye, A., Fujii, H., Ndiaye, M. M., Yamoah, F. A., & Koh, S. C. L. (2021). A critical analysis of the impacts of COVID-19 on the global economy and ecosystems and opportunities for circular economy strategies. Resources, Conservation, and Recycling, 164, 105169. https://doi.org/10.1016/J.RESCONREC.2020.105169

Ismail, N., & Amiruddin Zaki, N. D. (2019). Does financial literacy and financial stress effect the financial wellness? International Journal of Modern Trends in Social Sciences, 2(8), 1-11. https://doi.org/10.35631/ijmtss.28001

Kemisola, O., Fazil Sabri, M., & Zainal Badari, S. A. (2019). Financial well-being of Nigerian family in Ikeja Lagos State Nigeria. Shanlax International Journal of Management, 7(1), 1-8. https://doi.org/10.34293/management.v7i1.536

Kieft, S., Fischer, S., & Schmitt, J. (2024). Self-employed and stressed out? The impact of stress and stress management on entrepreneurs’ mental health and performance. Frontiers in Psychology, 15, 1365489. https://doi.org/10.3389/fpsyg.2024.1365489

Lobos, G., Schnettler, B., Lapo, C., Núñez, M., & Vera, L. (2021). Financial distress/well-being and living situation in Ecuadorian health workers. Cadernos de Saude Publica, 37(8), 1-13. https://doi.org/10.1590/0102-311X00164520

MacCallum, R. C., Browne, M. W., & Sugawara, H. M. (1996). Power analysis and determination of sample size for covariance structure modeling of fit involving a particular measure of model. Psychological Methods, 13(2), 130-149. https://doi.org/10.1037//1082-989x.1.2.130

Mahdzan, N. S., Zainudin, R., Abd Sukor, M. E., Zainir, F., & Wan Ahmad, W. M. (2020). An exploratory study of financial well-being among Malaysian households. Journal of Asian Business and Economic Studies, 27(3), 285-302. https://doi.org/10.1108/JABES-12-2019-0120

Mahdzan, N. S., Zainudin, R., Sukor, M. E. A., Zainir, F., & Wan Ahmad, W. M. (2019). Determinants of subjective financial well-being across three different household income groups in Malaysia. Social Indicators Research, 146(3), 1-31. https://doi.org/10.1007/s11205-019-02138-4

Martin, E. C., & Dwyer, R. E. (2021). Financial stress, race, and student debt during the Great Recession. Social Currents, 8(5), 424-445. https://doi.org/10.1177/23294965211026692

Mathew, V., Kumar, S., & Ma, S. (2022). Financial well-being and its psychological determinants: An emerging country perspective. FIIB Business Review, 13(1), 231971452211210. https://doi.org/10.1177/23197145221121080

Mende, M., & van Doorn, J. (2015). Coproduction of transformative services as a pathway to improved consumer well-being: Findings from a longitudinal study on financial counseling. Journal of Service Research, 18(3), 351-368. https://doi.org/10.1177/1094670514559001

Mendes, K., Matheis, T., Bressan, A., Grigion, A., Klein, L., & Amaral, T. (2023). Construction and validation of a perceived financial well-being scale (PFWBS). International Journal of Bank Marketing, 41(1), 179-209. https://doi.org/10.1108/IJBM-04-2022-0148

Millones-Liza, D., & Garcia-Salirrosas, E. (2024). Financial Well-Being Scale: Evidence of validity and reliability in Peruvian context. Academic Journal of Interdisciplinary Studies, 13(3), 340. https://doi.org/10.36941/ajis-2024-0085

Mokhtar, N., Husniyah, A. R., Sabri, M. F., & Abu Talib, M. (2015). Financial well-being among public employees in Malaysia: A preliminary study. Asian Social Science, 11(18), 49-54. https://doi.org/10.5539/ass.v11n18p49

Muat, S., Mahdzan, N. S., & Sukor, M. E. A. (2024). What shapes the financial capabilities of young adults in the US and Asia-Pacific region? A systematic literature review. Humanities and Social Sciences Communications, 11(1), 83. https://doi.org/10.1057/s41599-023-02588-9

Netemeyer, R. G., Warmath, D., Fernandes, D., & Lynch, J. G. (2018). How am I doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68-89. https://doi.org/10.1093/JCR/UCX109

Ng, W., & Diener, E. (2014). What matters to the rich and the poor? Subjective well-being, financial satisfaction, and postmaterialist needs across the World. Journal of Personality and Social Psychology, 107(2), 326-338. https://doi.org/10.1037/a0036856

Ngamaba, K. H., Armitage, C., Panagioti, M., & Hodkinson, A. (2020). How closely related are financial satisfaction and subjective well-being? Systematic review and meta-analysis. Journal of Behavioral and Experimental Economics , 85, 101522. https://doi.org/10.1016/j.socec.2020.101522

O’Neill, B., Sorhaindo, B., Xiao, J. J., & Garman, E. T. (2005). Financially Distressed Consumers: Their Financial Practices, Financial Well-Being, and Health. Journal of Financial Counseling and Planning, 16(1), 1-15.

Organisation for Economic Co-operation and Development. (2023). OECD/INFE 2023 International Survey of Adult Financial Literacy. https://www.oecd.org/en/publications/oecd-infe-2023-international-survey-of-adult-financial-literacy_56003a32-en.html

Organisation for Economic Co-operation and Development. (2024). Household savings forecast (Indicator). https://data.oecd.org/hha/household-savings-forecast.htm

Ponchio, M. C., Cordeiro, R. A., & Gonçalves, V. N. (2019). Personal factors as antecedents of perceived financial well-being: evidence from Brazil. International Journal of Bank Marketing, 37(4), 1004-1024. https://doi.org/10.1108/IJBM-03-2018-0077/FULL/XML

Pons, D., Atienza, F., Balaguer, I., & Garcia-Merita, M. (2002). Propiedades psicométricas de la escala de satisfacción con la vida en personas de tercera edad. Revista Iberoamericana de Diagnóstico y Evaluación Psicológica, 1(13), 71-82.

Prawitz, A. D., Garman, E. T., Sorhaindo, B., O’Neill, B., Kim, J., & Drentea, P. (2006). InCharge financial distress/financial well-being scale: Development, administration, and score interpretation. Journal of Financial Counseling and Planning, 17(1), 34-50. https://doi.org/10.1037/t60365-000

Rahman, M., Isa, C. R., Masud, M. M., Sarker, M., & Chowdhury, N. T. (2021). The role of financial behaviour, financial literacy, and financial stress in explaining the financial well-being of B40 group in Malaysia. Future Business Journal, 7(1), 1-18. https://doi.org/10.1186/s43093-021-00099-0

Rosseel, Y. (2012). lavaan : An R Package for Structural Equation Modeling. Journal of Statistical Software, 48(2), 1-93. https://doi.org/10.18637/jss.v048.i02

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30(6), 708-723. https://doi.org/10.1016/J.APPDEV.2009.02.003

Simancas-Pallares, M., Diaz-Cardenas, S., Barbosa-Gomez, P., Buendia-Vergara, M., & Arevalo-Tovar, L. (2016). Propiedades psicométricas del Índice de Bienestar General-5 de la Organización Mundial de la Salud en pacientes parcialmente edéntulos. Revista de la Facultad de Medicina, 64(4), 701-705. https://doi.org/10.15446/revfacmed.v64n4.52235

Sivaramakrishnan, S., & Srivastava, M. (2019). Financial well-being, risk avoidance and stock market participation. International Journal of Financial Services Management, 9(4), 326. https://doi.org/10.1504/ijfsm.2019.10024217

Sorgente, A., & Lanz, M. (2019). The multidimensional subjective financial well-being scale for emerging adults: Development and validation studies. International Journal of Behavioral Development, 43(5), 466-478. https://doi.org/10.1177/0165025419851859

Sorgente, A., Atay, B., Aubrey, M., Bhatia, S., Crespo, C., Fonseca, G., Güneri, O. Y., Lep, Ž., Lessard, D., Negru-Subtirica, O., Portugal, A., Ranta, M., Relvas, A. P., Singh, N., Sirsch, U., Zupančič, M., & Lanz, M. (2024). One (Financial Well-Being) model fits all? Testing the Multidimensional Subjective Financial Well-Being Scale across nine countries. Journal of Happiness Studies, 25(1), 13. https://doi.org/10.1007/s10902-024-00708-z

Svetina, D., Rutkowski, L., & Rutkowski, D. (2020). Multiple-group invariance with categorical outcomes using updated guidelines: An illustration using Mplus and the lavaan/semTools packages. Structural Equation Modeling, 27(1), 111-130. https://doi.org/10.1080/10705511.2019.1602776

Utkarsh, Pandey, A., Ashta, A., Spiegelman, E., & Sutan, A. (2020). Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. International Journal of Consumer Studies, 44(6), 531-541. https://doi.org/10.1111/ijcs.12583

Ventura-León, J. (2019). Back to content-based validity. Adicciones, 34(4), 1-4. https://doi.org/10.20882/adicciones.1213

Williams, F. L. (1989). Family and personal resource management as affecting the quality of life. Thinking Globally, 10, 237-250. https://doi.org/10.1007/BF00989506

Wu, H., & Estabrook, R. (2016). Identification of confirmatory factor analysis models of different levels of invariance for ordered categorical outcomes. Psychometrika, 81(4), 1014-1045. https://doi.org/10.1007/s11336-016-9506-0

Funding: This study did not receive any external funding or financial support.

Data availability: The dataset supporting the results of this study is not available.

Conflict of interest: The authors declare that they have no conflicts of interest.

How to cite: Mamani-Benito, O., Palomino Mariño, C. O., Carranza Esteban, R. F., Caycho-Rodríguez, T., Castillo-Blanco, R., Pacheco Vizcarra, M. Y., & Morales-García, W. C. (2025). Translation, Adaptation and Validation of the Financial Distress/Financial Well-Being Scale in Economically Active Adults from the Peruvian Highlands. Ciencias Psicológicas, 19(2), e-4407 https://doi.org/10.22235/cp.v19i2.4407

Authors’ contribution (CRediT Taxonomy): 1. Conceptualization; 2. Data curation; 3. Formal Analysis; 4. Funding acquisition; 5. Investigation; 6. Methodology; 7. Project administration; 8. Resources; 9. Software; 10. Supervision; 11. Validation; 12. Visualization; 13. Writing: original draft; 14. Writing: review & editing.

O. M. B. has contributed in 1, 4, 5, 6, 11, 12, 14; C. O. P. M. in 4, 5, 6, 11, 13; R. F. C. E. in 5, 6, 13, 14; T. C. R. in 5, 6, 13, 14; R. C. B. in 2, 3, 6, 12; M. Y. P. V. in 4, 7, 8, 11; W. C. M. G. in 5, 12, 13, 14.

Scientific editor in-charge: Dr. Cecilia Cracco.

Ciencias Psicológicas; v19(2)

July-December 2025

10.22235/cp.v19i2.4407